The 10-Second Trick For Pkf Advisory Services

The 10-Second Trick For Pkf Advisory Services

Blog Article

Pkf Advisory Services - Questions

Table of ContentsOur Pkf Advisory Services DiariesPkf Advisory Services Can Be Fun For AnyoneAn Unbiased View of Pkf Advisory ServicesThe smart Trick of Pkf Advisory Services That Nobody is DiscussingThe Greatest Guide To Pkf Advisory Services

Many people these days understand that they can not depend on the state for even more than the outright basics. Planning for retired life is a complex business, and there are various alternatives available. A financial adviser will certainly not only help sort through the numerous guidelines and product options and help build a portfolio to maximise your long term prospects.

Acquiring a house is among the most expensive choices we make and the substantial bulk people require a home mortgage. An economic advisor might save you thousands, particularly sometimes like this. Not just can they look for the best rates, they can aid you examine sensible levels of borrowing, make the most of your down payment, and may also locate lending institutions that would otherwise not be readily available to you.

Some Known Factual Statements About Pkf Advisory Services

An economic adviser recognizes just how items work in different markets and will certainly determine feasible drawbacks for you along with the prospective benefits, to ensure that you can after that make an informed choice about where to spend. Once your danger and financial investment evaluations are complete, the following action is to take a look at tax obligation; also the most fundamental overview of your placement could help.

For much more challenging plans, it can mean moving properties to your partner or children to increase their personal allowances rather - PKF Advisory Services. An economic adviser will constantly have your tax position in mind when making suggestions and factor you in the appropriate direction even in complicated scenarios. Also when your investments have been established and are going to strategy, they must be monitored in situation market advancements or uncommon occasions press them off course

They can assess their performance versus their peers, ensure that your possession appropriation does not become distorted as markets vary and assist you settle gains as the deadlines for your best goals move closer. Money is a challenging subject and there is lots to think about to shield it and maximize it.

Everything about Pkf Advisory Services

Employing a good economic consultant can reduce with the hype to guide you in the right instructions. Whether you require general, useful guidance or a specialist with committed proficiency, you could find that in the long-term the cash you buy professional guidance will certainly be paid back sometimes over.

Keeping these licenses and accreditations requires continual education and learning, which can be expensive and time-consuming. Financial experts require to stay upgraded with the most up to date industry trends, regulations, and ideal practices to offer their customers effectively. Despite these difficulties, being a certified and licensed monetary advisor uses immense advantages, including numerous occupation chances and greater making possibility.

The Facts About Pkf Advisory Services Revealed

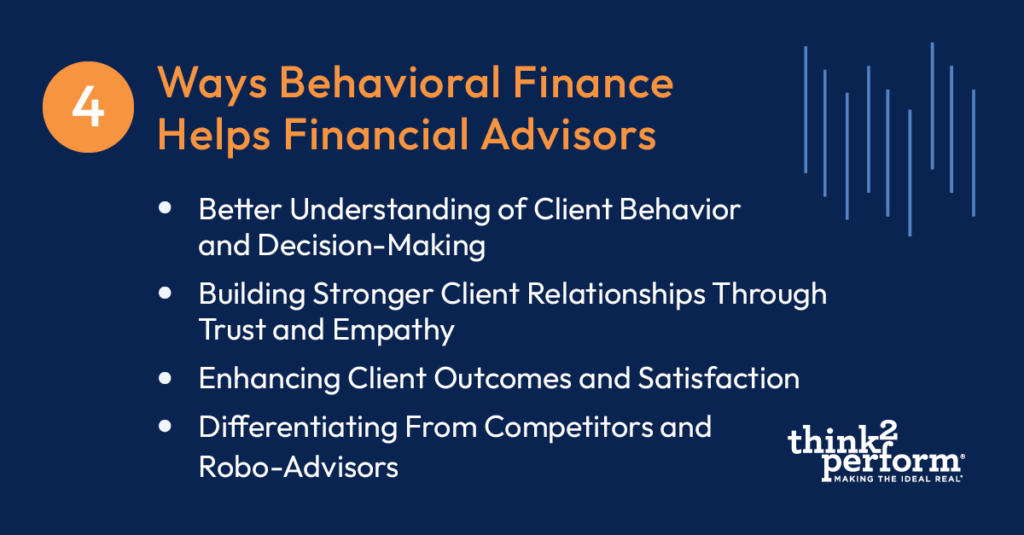

Compassion, logical skills, behavioral financing, and superb interaction are critical. Financial advisors work carefully with customers from varied histories, helping them navigate complex economic choices. The ability to pay attention, understand their distinct requirements, and give tailored recommendations makes all the distinction. Surprisingly, previous experience in money isn't constantly a requirement for success in this field.

I began my profession in corporate finance, moving around and upwards throughout the company financing framework to refine skills that prepared me for the function I am in today. My selection to relocate from company money to individual finance was driven by personal needs in addition to the desire to aid the many individuals, households, and local business I currently serve! Attaining a healthy and balanced work-life balance can be testing in the very early years of an economic expert's profession.

The financial consultatory profession has a favorable outlook. This development is driven by factors such as a maturing populace requiring retired life planning and boosted awareness of the value of financial planning.

Financial experts have the distinct capacity to make a considerable influence on their clients' lives, assisting them achieve their economic goals and secure their futures. If you're passionate concerning finance and aiding others, this career path might be the excellent fit for you - PKF Advisory Services. To learn more details about coming to be a financial expert, download our detailed frequently asked question sheet

Not known Facts About Pkf Advisory Services

It does not contain any financial investment suggestions and does not address any individual facts and circumstances. Because of this, it can not be depended on as giving any kind of financial investment recommendations. If you would like investment suggestions concerning your certain truths and situations, please speak to a qualified financial expert. Any kind of visit this page investment involves some level of threat, and various kinds of investments involve differing levels of risk, including loss of principal.

Previous performance of any type of safety and security, indices, approach or allotment might not be indicative of future outcomes. The historic and current details regarding guidelines, regulations, guidelines or benefits had in this file is a recap of information acquired from or prepared by various other sources. It has not great post to read been individually verified, however was gotten from resources believed to be dependable.

A monetary expert's most valuable possession is not proficiency, experience, and even the capacity to create returns for customers. It's count on, the foundation of any type of effective advisor-client relationship. It sets a consultant besides the competitors and keeps clients coming back. Financial experts throughout the nation we talked to concurred that trust is the vital to building long lasting, efficient partnerships with customers.

Report this page